What is a Credit Score?

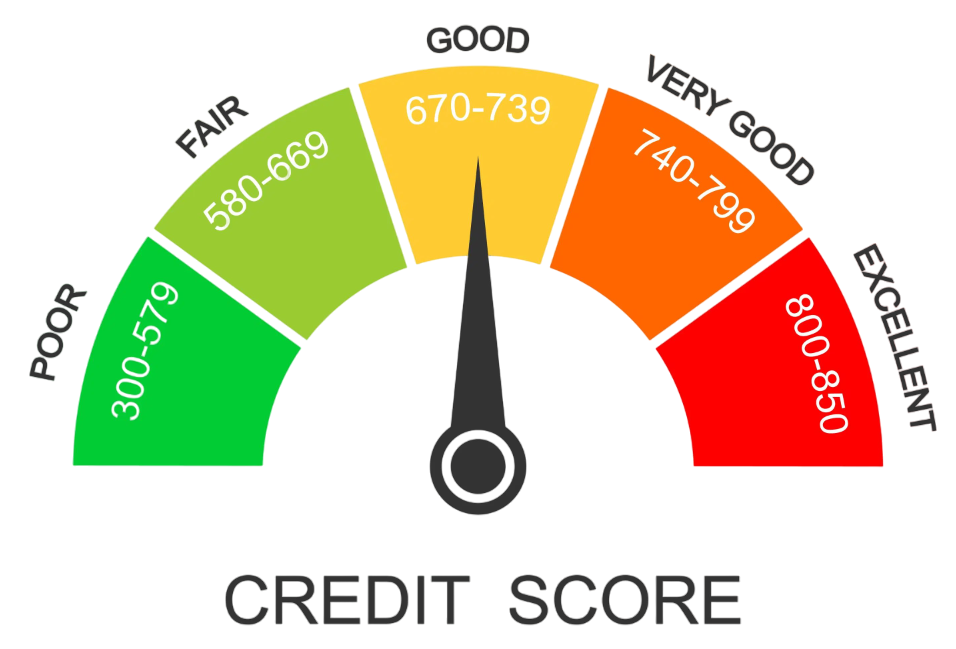

A credit score is a three-digit number that represents your financial reliability and creditworthiness. It usually ranges from 300 to 900 and is calculated based on factors such as repayment history, credit utilization, loan accounts, and credit inquiries. A high credit score indicates responsible financial behavior, making it easier to get loans or credit cards with lower interest rates. On the other hand, a low credit score may lead to loan rejections or higher interest charges. Maintaining a good credit score helps you build financial trust, improve loan eligibility, and secure better financial opportunities in the future.

Check Cibil Score